Financial Wellness

When it comes to your financial wellness, what is your attitude?

Is it time for a financial wellness makeover?

We think “financial wellness” may be best described as a thought and an approach pertaining to your financial status/situation that consists of:

- working on creating and maintaining a balance that includes being comfortable with where your money comes from and where it is going.

- balancing the mental, spiritual, and physical aspects of money as it pertains to your life.

- debt elimination.

Do you have an understanding of your financial wellness?

Some people do not and we encourage you, if you are one of them, to change that. You can start by asking yourself:

How would I describe my financial wellness?

Take a good look at your bank account and credit card transactions and ask yourself:

Am I living within my means?

Many people may not be. Gaining an understanding of your financial wellness can be helpful in determining if you are in fact living within your means and it is an important first step in learning how to do so. This is a good time to ask yourself another question:

What is my behavior as it pertains to my financial wellness?

If you are not living within your means, you may want to assess your behavior. Impulsive spending is a strong indicator that your need to create some balance. You are likely stressing over the negative results of such behavior and may want to ask yourself:

How satisfied , if at all, am I with my financial wellness?

Often when one is dissatisfied with any given situation it can be hard to face the reason, which makes it difficult to take a new or different approach to improving it. Many people strive to improve their situation, only to get blind sided by an unexpected repair or a medical bill, loss of employment, etc. This creates a difficult environment in which to maintain financial wellness. All of this leads to yet another question to ask yourself:

Am I taking care of my financial wellness in such a way that I am prepared for financial changes?

For many, that is easier said than done. Having money set aside for the unexpected can be wonderful, but many people find it difficult or impossible to do. At the end of the month it is not always feasible to take that $50 you wanted to put into the emergency fund because it had to be spent on another emergency.

I know we are not really painting a pretty picture, and we do hope that your picture is prettier. However, if it is not, then the next few questions are crucial:

Am I willing to:

- learn how to manage my finances for the short and the long term?

- change my thoughts and my approach as it pertains to my financial wellness ?

- strive and commit to working on creating and maintaining a balance that includes being comfortable with where my money comes from and where it is going?

- strive and commit to working on creating and maintaining a balance between the mental, spiritual, and physical aspects of money as it pertains to my life?

- eliminate debt?

We have suggested that you ask yourself a lot of questions and we encourage you to seek some answers. In the meantime, we did a little seeking for you . We hope that you find the following information to be helpful.

Each of the three credit agencies will provide FREE annual report through www.annualcreditreport.com (This website is the only one that is government authorized to provide you with free copies of your credit report).

- Equifax or by phone at 1-800-685-1111

- Experian or by phone at 1-888-397-3742

- TransUnion or by phone at 1-800-916-8800

7. Eliminate debt and credit card debt. Credit cards can make it easy to pile on debt. If your debt adds up faster than you can pay it off, you’re likely living beyond your means. Stop using the credit cards and pay off existing balances. The sooner you do, the less you’ll pay in interest. Remember, not all debt is bad. Taking on loans for higher education or to buy a home may really be an investment in your future.

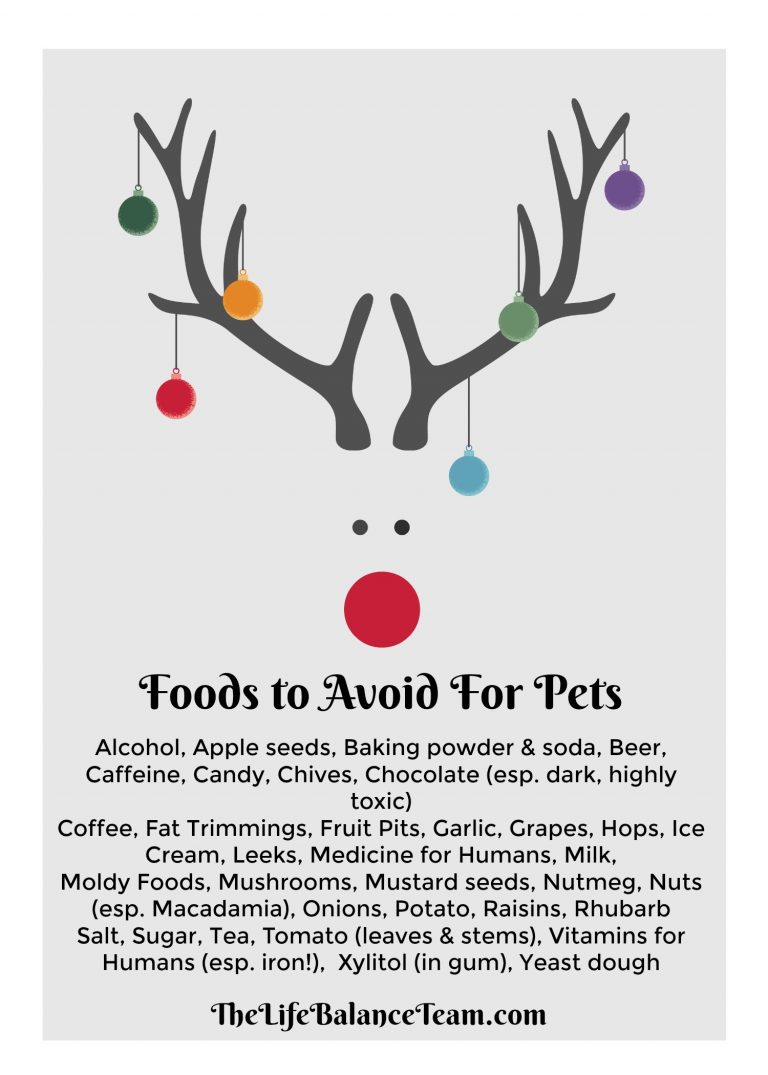

Physical: If you take care of yourself physically, that means fewer doctor office visits and fewer prescriptions. Eating healthy is not as expensive as everyone claims AND your health will be a big pay off!